Some Thai Laws Foreign Nationals should understand

Here is a personal summary of some critical aspects of Thai law as it relates to foreign nationals in Thailand: It is not professional advice but encourages everyone in need to seek such.

- Visas and immigration – Foreigners must have a valid visa to enter and stay in Thailand. Different types of visas have different requirements and allow different lengths of stay. Visa runs (leaving and re-entering to renew a tourist visa) are illegal. Overstaying a visa can result in fines, blacklisting, and deportation.

- Work permits – Foreigners who want to work in Thailand must get a work permit and/or work visa before starting employment. There are different categories of work permits based on the type of work. Working without a permit is illegal.

- Land ownership – Foreigners cannot directly own land in Thailand but may purchase condominium units. Foreign companies can own land for business purposes.

- Marriage – Foreigners marrying Thai nationals must follow legal procedures like document registration. Sham marriages for visa purposes are illegal. Foreign spouses have limited rights to property division in case of divorce or death.

- Taxes – Foreign residents may be liable for Thai taxes on income earned from Thai sources. Thailand has double taxation agreements with many countries.

- Crime and punishment – Thailand has strict drug laws with long prison sentences. Bribery, overstaying visas, working illegally, and other crimes can mean fines, jail time, and blacklisting. Punishment is left to the judge’s discretion.

- Reporting requirements – Foreigners must report changes of address and other status changes to immigration authorities within specified time limits.

- Culture and etiquette – Foreigners must respect Thai culture, monarchy, and laws. Rude behaviour or indecency in public places can result in fines or arrest.

- The Civil and Commercial Code governs inheritance law. Rights depend on whether the deceased died testate (with a will) or intestate (without a will).

- Foreign spouses have no automatic legal right to inherit if their Thai spouse dies intestate. Thai law divides the estate between the deceased’s parents, children, and siblings.

- If the deceased left a will, a foreign spouse could inherit a portion of the estate as specified in the Will. However, under the Civil Code, children are entitled to inherit at least 50% of the estate regardless of what the will states.

- The remaining portion of the estate not inherited by children can be willed to a foreign spouse. This might be 50% of the total estate if there are children or the entire estate without children.

- Adopted foreign children have the same inheritance rights as biological children. Stepchildren have no automatic right to inherit.

- Foreigners cannot own land in Thailand, so a Thai must administer any land before it can pass to foreign heirs.

- The Thai heirs and administrators may not follow the stated wishes in a foreigner’s will if they can challenge it in court. Foreign wills can be open to different interpretations.

- Foreign heirs may need to probate the will and pay taxes in Thailand and their home country, which can be an intricate process. Hiring a lawyer is advisable.

If a foreign spouse dies in Thailand without a will (intestate), the inheritance rights of the surviving foreign spouse to joint property can get quite complicated:

- Under Thai law, all property acquired during the marriage is presumed to be jointly owned between spouses. This is known as “community property”.

- However, inheritance of community property when one spouse dies intestate is not straightforward for foreign spouses.

- By default, Thai inheritance laws favour the distribution of intestate property to blood relatives – children, parents, and siblings of the deceased. Foreign spouses are not included in this hierarchy.

- So, the foreign spouse does not automatically inherit their share of community property if their Thai spouse dies without a will.

- The foreign spouse must provide evidence in court that assets were acquired jointly during the marriage. Even then, they may only inherit half or less.

- Land and houses owned by the deceased Thai spouse will go to Thai heirs, as foreigners cannot legally own land.

- Foreign spouses have better inheritance rights to joint movable assets like cash, investments, and bank accounts – but proof is still required.

- The complex legal situation means the foreign spouse is often disadvantaged without a will. They may end up with little control or rights over the joint property.

- It is strongly advisable for foreign-Thai couples to have a will specifying inheritance wishes and shares of property to avoid dependence on Thai intestacy laws.

In summary, foreign spouses do not have automatically clear rights to the jointly owned property if their Thai spouse dies without a will. The Thai inheritance hierarchy prevails in such cases.

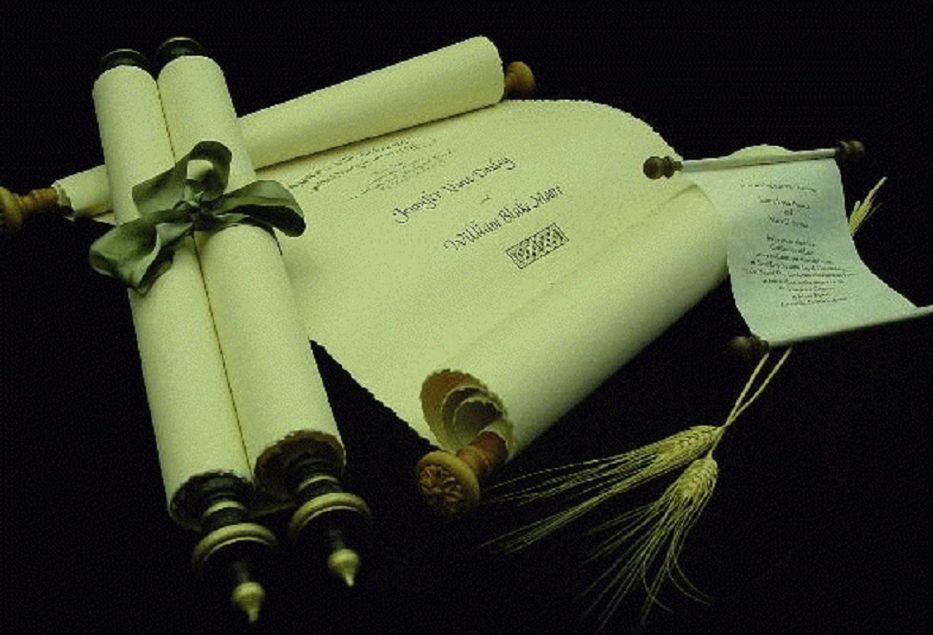

Laymen’s Example of a Testament

I, Nasri Smyth, a Thai citizen holding ID number XXXXXXXXXXXX, currently residing at 123 Sukhumvit Road, Bangkok, Thailand, being of sound mind, do hereby declare this to be my last will.

- I revoke all prior wills and codicils previously made by me.

- I am married to Peter Smyth, a British citizen holding passport number XXXXXXXX. We have no children together or individually.

- I designate my husband, Peter Smyth, as the sole beneficiary and heir to receive my entire estate upon my death.

- My estate consists of all property, assets, money, or other interests I owned at my death, whether owned by me individually or jointly with my husband.

- I nominate and appoint my husband, Peter Smyth , as the Executor of my will. If he is unwilling or unable to serve, I nominate Mr Tomas Higgins of Bangkok as the alternate executor.

- Any debts owed shall be paid from my estate. The residue shall be passed to my husband.

- I revoke any prior beneficiary designations on life insurance policies, financial accounts, or other assets so all such purchases form part of my estate.

- Any prior wills to this are entirely revoked.

Witnessing this, I sign my name on this 5th day of August 2023 in Bangkok, Thailand.

Nasri Smyth

Witnessed By: (Two Witness Signatures)

‘’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’

‘’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’

Notes

- Inheritance tax laws – Thailand has high inheritance tax rates. The foreign spouse may be liable for Thai inheritance taxes as a beneficiary. Understanding the tax implications is essential.

- Probate – They will likely need to be probated and validated in a Thai court after the spouse’s death. Hiring a local Thai lawyer to assist with probate helps ensure the will is executed correctly.

- Land ownership – Foreigners cannot directly own land in Thailand. Consider how land assets would be transferred and owned after your spouse’s passing.

- Division of assets – Consider whether certain assets should be divided or allocated differently than in the broad example provided.

- Beneficiaries – Decide if you want to add any secondary or contingent beneficiaries along with the foreign spouse.

- Executors – Choose executors wisely as they enact the will’s instructions.

- Updating the will – Be sure to review and update the will occasionally in case your circumstances or wishes change over time.

- Get documents like marriage/divorce certificates properly certified if they will be used for legal purposes in Thailand.

- Punishment for drug offences can carry severe penalties compared to other countries.

Translate

Translate